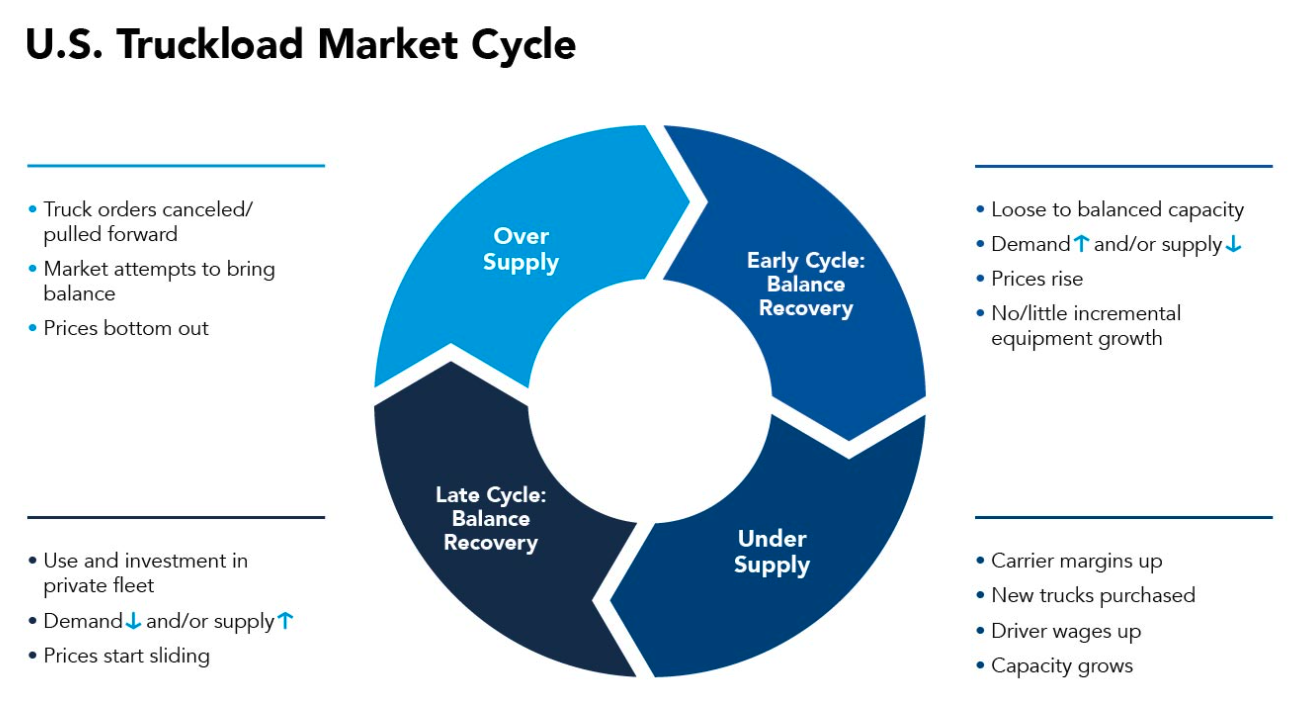

The historical truckload cycle offers valuable insights into today’s freight market dynamics and helps us anticipate future trends as we analyze the balance between demand and supply. Understanding this pattern can be a powerful tool for shippers, carriers, and logistics professionals looking to make informed decisions.

The U.S. truckload sector follows a predictable cycle that repeats over time. C.H. Robinson has done an excellent job of visualizing this process in a helpful graphic based on our breakdown of the truckload cycle.

So why does understanding the truckload cycle matter? By combining this knowledge with ACT's Class 8 tractor data, you gain a clearer picture of where the market is heading. This allows for better planning and preparation as the cycle progresses.

**Early Cycle: Demand Recovery**

The cycle often starts in a loose or balanced environment, where freight demand begins to grow. As demand increases, capacity tightens, leading to driver shortages. This shift gives more power to truckers, who push rates up first in the spot market, and then in contracts about six months later. During this phase, Class 8 tractor production is typically low, but load-to-truck ratios and rates begin to rise, along with growing orders for new equipment.

**Mid-Cycle: Capacity Expansion**

As rates increase, fleet operators see improved profit margins, which allow them to attract more drivers by offering higher pay. With better financials, fleets start investing in new trucks and trailers, driving up industry production. Due to the fragmented nature of the market, many fleets make similar decisions at the same time, often leading to overcapacity. This stage is marked by high tractor build rates and long order backlogs.

**Mid-Late Cycle: Shipper Adjustments**

At this point, shippers begin to look for ways to reduce costs by improving productivity and shifting more freight to their private fleets. Meanwhile, the cycle is reaching its peak, and for-hire freight growth starts to slow or even reverse. As supply outpaces demand, truckload rates fall, hurting carrier profitability. This leads to reduced order activity and increased cancellations.

**Late Cycle: Lower Returns and Correction**

Driver shortages become less of a concern, and carriers start cutting back on equipment purchases and canceling orders. This slows down production, gradually bringing supply and demand back into balance. Eventually, freight demand picks up again, and the cycle begins anew.

By staying aware of these phases, businesses can better navigate the truckload market and position themselves for success in each stage of the cycle.

Jewelry Accessories,Stainless Steel Heart Parts,316L Stainless Steel Heart Parts,304 Stainless Steel Heart Parts

Dongguan New Decoration Material Technology Co., Ltd. , https://www.xsjmim.com